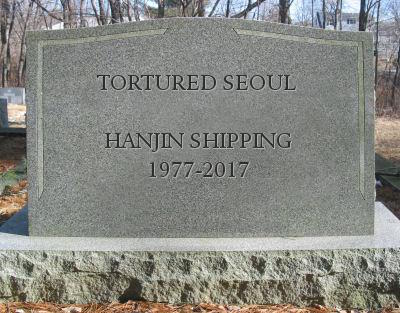

No Joy for Hanjin Creditors

In New Jersey USA last week, a bankruptcy court heard that creditors of South Korea's Hanjin Shipping are likely to see a return of less than two cents to the dollar. Trustees tasked with attempting to recover funds told the court that claims approved so far totalled US$10.2 billion, yet recoveries had just reached US$220 million and many more claims remain to be processed.

When Hanjin collapsed in August last year, it was estimated that over 500,000 TEU worth of cargo was left stranded, including in terminals and on over 100 Hanjin container ships. When Hanjin filed for bankruptcy protection, they disclosed a deficit of around US$5 billion. The first creditors' meeting was due to have been held at the beginning of this year, but postponed amidst reports that claims amounted to at least US$26 billion and counting. The meeting finally took place in Seoul on 1 June and was attended by 180 creditors representing some 3,000 claimants.

At last week's New Jersey hearing in a statement to the court, Jin Han Kim, managing partner of Seoul-headquartered DR & AJU International Law Group, said it was "uncertain when initial distributions will be made to creditors holding admitted claims".

During the reporting season a number of businesses have disclosed substantial losses caused by Hanjin debts. These include non-operating shipowners including Seaspan and Danaos (whose charter revenue collapsed by one fifth) and container leasing company Textainer, which revealed its own ability to invest in new containers had been severely impacted by Hanjin losses and the cost of recovering containers worldwide leased to Hanjin.

When Hanjin collapsed in August last year, it was estimated that over 500,000 TEU worth of cargo was left stranded, including in terminals and on over 100 Hanjin container ships. When Hanjin filed for bankruptcy protection, they disclosed a deficit of around US$5 billion. The first creditors' meeting was due to have been held at the beginning of this year, but postponed amidst reports that claims amounted to at least US$26 billion and counting. The meeting finally took place in Seoul on 1 June and was attended by 180 creditors representing some 3,000 claimants.

At last week's New Jersey hearing in a statement to the court, Jin Han Kim, managing partner of Seoul-headquartered DR & AJU International Law Group, said it was "uncertain when initial distributions will be made to creditors holding admitted claims".

During the reporting season a number of businesses have disclosed substantial losses caused by Hanjin debts. These include non-operating shipowners including Seaspan and Danaos (whose charter revenue collapsed by one fifth) and container leasing company Textainer, which revealed its own ability to invest in new containers had been severely impacted by Hanjin losses and the cost of recovering containers worldwide leased to Hanjin.